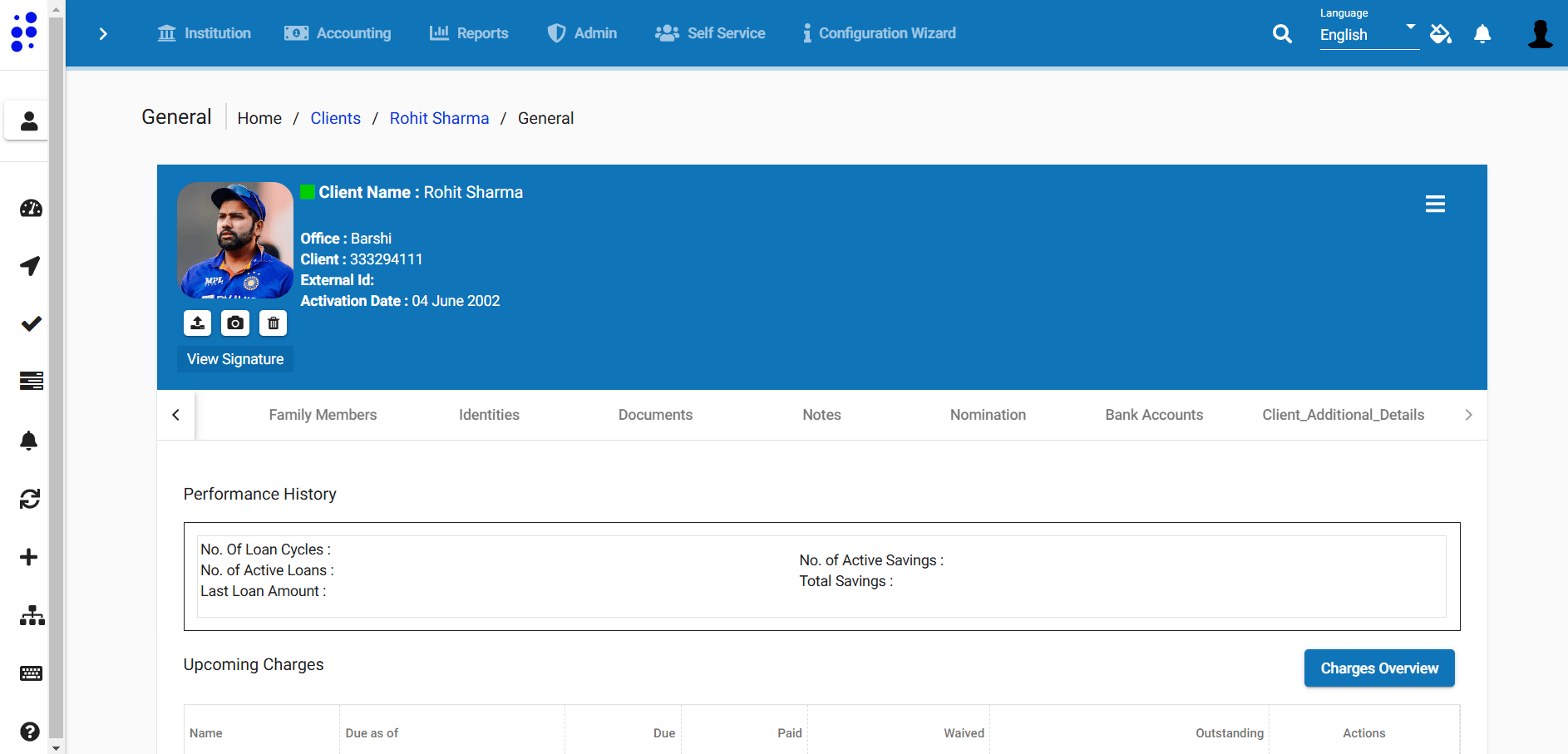

Applicant Management

- Capture, verify and store KYC details as per regulations

- Verify the Mobile number of the applicant using OTP

- Capture and store Nominee details of the applicant

- Capture and store Bank Account details of the applicant for fund transfer

- Capture and store Address details of the applicant